Results for "Tax"

Display 21-30 of 170

-

-

Commercial and Industrial Property Tax Reform webinar

09/04/2024

The Victorian Commercial and Industrial Property (CIPT) Tax Reform is the most significant Victorian property tax reform in more than 30 years. Anyone looking to buy or sell commercial or industrial property should stay informed. SW is delighted to invite you to our Commercial and Industrial Property Tax Reform webinar where our experts will share […]

-

-

Victorian Property Tax Reform

26/03/2024

The new Victorian Commercial and Industrial Property Tax (CIPT) will impact property purchases after 1 July 2024. This is a significant change to transition away from stamp duty for commercial and industrial property. There are numerous complexities in the proposed legislation. The Commercial and Industrial Property Tax Reform Bill 2024 was introduced into the Victorian […]

-

-

Tax Chat webinar series

21/03/2024

Explore the latest in the world of taxation in our Tax Chat webinar series. Join us for three engaging sessions on the most recent tax rulings, cases and key developments shaping the tax landscape. During these sessions, our newest Tax Partners, Kirsty McDonnell and Vanessa Priest, will be discussing all things tax- including updates to […]

-

-

CTS for Corporates

08/03/2024

CTS enables you to streamline and automate your entire tax reporting and compliance process. These include: CTS streamlines the calculation of tax balances to be included in the financial statements. The outcome – CTS delivers increased integrity, efficiency and effectiveness. CTS automatically: This means that the complex tax effect accounting is simplified, with the […]

-

-

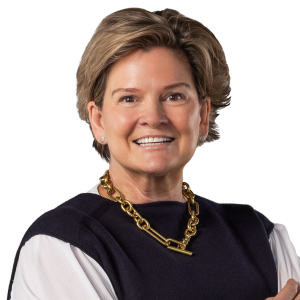

Kirsty McDonnell, Partner

04/03/2024

With over 18 years of experience as a tax specialist, Kirsty has worked extensively with privately owned groups and listed entities. Her expertise spans tax compliance, tax effect accounting, restructures, tax consolidations, employee share schemes, small business CGT, trust tax issues, and international tax matters. Kirsty has a proven track record in tax controversy, handling […]

-

-

Vanessa Priest, Partner

04/03/2024

Vanessa has more than 25 years experience as a tax specialist, with an interest in the tax and succession issues faced by privately owned enterprises and family groups. She has extensive knowledge in areas such as tax structuring, cross border issues, asset acquisitions and divestments, and tax issues arising for trusts. She has written and […]

-

-

Navigating tax implications of holding vacant land

14/12/2023

The Meakins case examines the deductibility of holding costs for vacant land. The findings emphasise the importance of demonstrable, income-generating activities to support tax deduction claims on vacant land, offering crucial insights for property investors and taxpayers. The recent Administrative Appeals Tribunal (AAT) case Meakins and Commissioner of Taxation [2023] AATA 3852 (Meakins), highlights its […]

-

-

Simplification in FBT Record-Keeping | Update

24/10/2023

The Australian Taxation Office (ATO) has introduced five further legislative instruments aimed at reducing Fringe Benefit Tax (FBT) record-keeping obligations. This is in addition to the four draft legislative instruments that we discussed in our earlier alert from March 2023. While the earlier legislative instruments focused on travel benefits, these new instruments broaden the scope […]

-

-

OECD Pillar Two GloBE rules – Global and domestic minimum tax seminar

24/10/2023

Our 2023 OECD Pillar Two GloBE rules – Global and domestic minimum tax seminar provided an update of the new requirements impacting multinational groups. Our online seminar was delivered in an interactive format with SW expert Daren Yeoh, Partner and Corporate & International Tax Director. This seminar covered the following topics: SW Speaker Daren YeohPartner […]

-

-

Australia's best kept accounting secret

23/10/2023