The final Higher Education Research Data Collection (HERDC) specifications for the collection of 2024 data have been released. It’s a great outcome to have further clarification on the treatment of Shared Income to Non-Higher Education Providers (HEPS).

The main changes between the 2023 specifications and 2024 specifications are as follows:

- Reorganisation of sections: The ‘HERDC specifications – updates to note’ section was moved to the beginning of the document, and the ‘Introduction’ was shifted to the second section to enhance the document’s flow.

- Clarification on data usage: A minor amendment was made to specify that preliminary HERDC data may be shared with Knowledge Commercialisation Australasia (KCA) to assist with its Survey of Commercialisation Outcomes from Public Research (SCOPR) data collection, validation, and reporting processes.

- Materials required: The table detailing required materials was reworded and repositioned within the document for better comprehension.

- Inclusions and exclusions on income return:: Section 4.2.1(a) was restructured into parts (a) and (b) to provide clearer guidance on non-Commonwealth Government top-ups.

- Subsidiaries and affiliates: Clarifications were made regarding the eligibility of subsidiaries and affiliates as research end-users for the Research Training Program (RTP) industry internship weighting.

- Shared income: An example was expanded to demonstrate the treatment of shared income with non-HEP organizations that are neither affiliates nor subsidiaries. Example: If HEP A receives a grant of $50,000 and allocates $20,000 to HEP B and $5,000 to a non-HEP organization that is not an affiliate or subsidiary, HEP A should report only the remaining $25,000 as its R&D income. HEP B would report the $20,000 it received, while the $5,000 allocated to the non-HEP organization is not reportable by either HEP.

- Sub-category 3.8 International Government (Other): Grants from the US National Institutes of Health were removed as an example in this sub-category.

- References to the department: Updates were made to clarify that references to the department pertain to the Australian Government Department of Education.

Each HEP must arrange for an audit of the Category 1, 2, 3 and 4 R&D income in their respective R&D income return and provide the department with a Special Purpose Audit Report under the Auditing and Assurance Standard Board (AASB) Auditing Standard ASA800, which clearly certifies that the R&D income recorded is correct. The audit report is due 30 June 2025.

How SW can help

With a dedicated education group, we specialise in performing HERDC audits for HEPS. If you are looking for an experience team to perform your HERDC audit, please reach out to Christine Krause and Matthew Paull.

We will be at ARMS 2025 Melbourne Conference– looking forward to connecting and sharing insights from the HERDC 2024 audits.

The Full Federal Court decision in the Bendel appeal1 has significant implications for Division 7A, overturning the Commissioner’s long-standing position that treats unpaid present entitlements as loans.

Background

The Full Federal Court has unanimously dismissed the Commissioner’s appeal from the AAT decision in the Bendel case in its judgement handed down on 19 February 2025.

Full details of the original AAT decision and relevant background can be found in our previous alert here.

The facts involved the Commissioner applying his long-standing view that an unpaid present entitlement (UPE) owed to a private company would fall within the definition of a ‘loan’ for Division 7A purposes. In the Commissioner’s view (as first published in Taxation Ruling TR 2010/3 and Law Administration Practice Statement PS LA 2010/4 as subsequently refined in Taxation Determination TD 2022/11), a UPE owed to a private company will be a loan for Division 7A purposes in the year following that in which the distribution is made.

The term ‘loan’ has an extended statutory definition for Division 7A purposes and includes ‘the provision of credit or any other form of financial accommodation’ and ‘a transaction (whatever its terms or form) which in substance effects a loan of money’. Prior to the Federal Court decision in Bendel, the Commissioner’s view has essentially been that a UPE that remains outstanding once the company has knowledge of the UPE would be a loan within the meaning of one or both of these elements of the extended definition.

The decision

The basis of the Full Federal Court in Bendel is disarmingly straightforward. The Court placed particular importance on various statutory provisions in Division 7A that referred to the ‘repayment’ of a loan and noted the distinction between a transaction or arrangement that creates an obligation to repay an amount and a transaction or arrangement that creates an obligation to pay an amount. Having regard to the language used in the relevant provisions of Division 7A, the Court concluded that to fall within the definition of ‘loan’ for Division 7A purposes the arrangement must be one that gives rise to an obligation to repay. A UPE is lacking this fundamental feature because the trustee of the relevant trust has an obligation to pay or discharge a UPE but does not constitute an obligation to repay the relevant amount. The Court’s view is succinctly stated in paragraph 93 of the judgement as follows:

‘…..s 109D(3) requires more than the existence of a debtor-creditor relationship. It requires an obligation to repay and not merely an obligation to pay.’

Whilst the Full Federal Court decision confirms the correctness of the AAT decision, the reasoning of the Full Federal Court was different. The AAT decision focussed less on interpretation of the relevant statutory provisions and more on the history of the relevant provisions and extraneous material. The appeal judgement is much more conventional and based on the interpretation of the provisions of Division 7A itself.

What does the decision mean?

This judicial decision is a major blow to the Commissioner and will potentially have widespread ramifications for private groups where the use of company beneficiaries is commonplace. The emphatic Full Federal Court decision means that, as the law stands, a UPE is not a loan for Division 7A purposes.

Unless the Commissioner seeks and is granted special leave for a High Court appeal which then overturns the Full Federal Court decision, this decision will stand. This would mean that the Commissioner would need to resile from his position that a UPE owed to a private company represents a loan made by the private company to the distributing trust.

A number of public rulings, practice statements and determinations are based on the premise that has been unanimously rejected by the Full Federal Court, including but not limited to those pronouncements referred to above. The decision will have potential implications not only for UPEs owing directly between a trust and a private company beneficiary, but also the Division 7A rules relating to transactions undertaken by trusts where there is a UPE owing to a company beneficiary (Subdivision EA of Division 7A).

The original AAT Bendel decision was widely regarded as interesting but, being a decision of the AAT, was one that was viewed with some caution. The unanimous Full Federal Court decision is clearly quite a different proposition.

Practical issues – what to do with UPEs?

Until the matter of any further appeal process is determined, the practical question that requires consideration is how to deal with any UPEs affected by the decision in the meantime. This may affect UPEs that came into existence in the 2023 year that, in the Commissioner’s view prior to the latest Bendel decision, were regarded as loans in the 2024 year. It will also impact 2024 and subsequent years’ UPEs until the final outcome is known with certainty. In addition, this important decision will clearly impact on some existing ATO reviews and disputes on foot relating to private groups.

It is unlikely that a decision with respect to the Commissioner’s special leave application (if made) would be known prior to lodgement date of the 2024 tax returns. It is possible that the ATO may approach the Federal Government for a legislative amendment in response to this decision. However, given that an election is only months away, it is unlikely that any legislative change will happen in the near term.

We would expect the Commissioner would issue a Decision Impact Statement and/or a Practical Compliance Guideline on the current decision in the event that an appeal is sought. Taxpayers and ATO officers will need guidance as to how to practically deal with UPEs owing to private companies in the event that the Commissioner seeks to (and is granted leave to) appeal the decision.

A further word of caution.

A further word of caution should also be noted. As resounding a victory as this decision is for the taxpayer, assuming that the decision stands, it does not mean that UPEs owing to companies can be left on foot indefinitely without fear of challenge by the Commissioner. The Commissioner has other ‘weapons in his armoury’ that could be deployed to challenge long-standing UPEs owing to corporate (or, indeed, other) beneficiaries of a trust, including section 100A. The Commissioner’s views on the potential application of section 100A to trust distributions to beneficiaries. that remain unpaid also need to be borne in mind when considering trust distribution matters. The Commissioner’s views on section 100A are themselves the subject of some controversy and will presumably subject to judicial review at some future date, but for the present these views remain on foot.

Furthermore, as noted above, if UPEs owing to companies are left on foot, Trusts will need to be cautious about lending to other associated entities due to the application of Subdivision EA.

How SW can help

SW will continue to monitor and keep you informed on a timely basis of any further developments in this space. It will be important to closely monitor the ATO’s response to this decision and any appeal process that might be instigated by the ATO.

In the meantime, discuss the Bendel decision and its impact on your own group’s UPEs with your SW contact or the contacts listed for this article.

Contributors

[1] Commissioner of Taxation v Bendel [2025] FCAFC 15.

The Land Tax Assessments for 2025 are being issued by the relevant State Revenue Offices (SRO). Are they correct and are you paying too much Land Tax?

Usual Land Tax Assessment process

Each Council/Shire engages a Licensed Valuer for the purpose of valuing each property in their municipality in respect of:

- The Capital Improved Value (CIV) – Land plus any improvements

- Site Value/Unimproved Land Value – Land Only

If you conduct any building activity including obtaining certain permits, the council/shire can issue an Amended Rates Notice at any time.

The Council/Shire will declare a range of rates during their annual budgeting process that will then been multiplied usually by the CIV to determine the annual council/shire rates payable by the land owner.

The rates will vary depending upon the use and the relevant planning scheme that applies to the land. For instance there will generally be different rates per dollar for:

- Residential Land containing a dwelling

- Vacant Residential Land

- Industrial Land

- Vacant Industrial Land

- Farm Land

- Native Vegetation etc.

Objecting a Council/Shire Rates Notice

You usually have 60 days to object to a Council/Shire Rates Notice from the issue date, with most objections being:

- Inappropriate valuation

- Assessed area being incorrect

- Incorrect classification/rate applied

- Property no longer owned etc.

The Council/Shire then provides the following two values to the SRO:

- Site Value – used to produce the Land Tax Assessments

- CIV – used to calculate Vacant Residential Land Tax

The 2025 Land Tax Assessments take into account land held at midnight on 31 December 2024 and use the value as prepared by councils in 2024.

Is your Land Tax assessment correct?

You also have 60 days to object to a Land Tax Assessment from the issue date.

In addition, as Land Tax is a self-assessment system you need to consider whether:

- all the land you or the entity owns is included and the apportionment is correct

- dimensions and description of the land being valued are correct

- is any land which you have bought/sold disclosed?

- if you receive multiple assessments for the same own – for instance individuals name may be spelt wrong etc

- any exemptions are correctly applied – for instance primary production land, principal place of residence, exempt status etc

- whether Absentee Owner Surcharge should be or should not be charged

- whether any Vacancy Residential Land Tax has been correctly assessed

- land subject to the Trust surcharge has been correctly assessed

- correct ownership is disclosed – trust as opposed to company etc.

It is often easier to object against the Council Rates Notice as in essence this information is then fed through to the SRO.

Where the valuation is not appropriate, it is prudent to obtain supporting evidence which in many cases will include a formal Valuation from a Property Valuer to support a lower and correct valuation.

There is a cost/benefit assessment to be done when lodging an objection.

How SW can help

To assist you we can:

- review the Land Tax Assessments to ensure that you are correct – remembering that it is a self-assessment system

- consider whether the Site Value is appropriate and if not consider lodging an objection.

The passing of the Build-to-Rent (BTR) Managed Investment Trust (MIT) legislation marks a pivotal moment for the Australian property market, addressing long-standing barriers to foreign investment and encouraging the growth of the BTR sector.

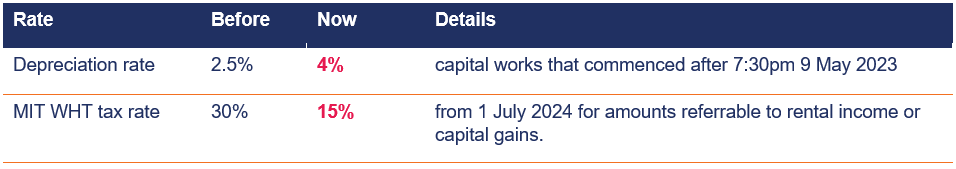

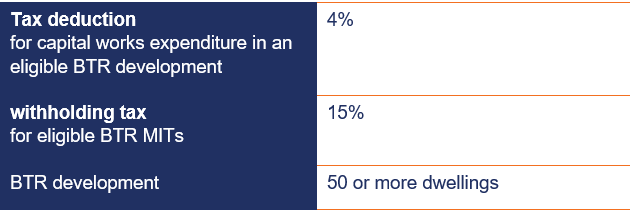

The legislation has passed both houses of parliament and will apply to eligible BTR developments to:

- increase the depreciation rate from 2.5% to 4% for capital works that commenced after 7:30pm 9 May 2023

- reduce the MIT WHT tax rate from 30% to 15% from 1 July 2024 for amounts referable to rental income or capital gains. This will align the MIT WHT rate with commercial property (i.e. office, retail and industrial).

The higher 30% MIT WHT rate was a major impediment to foreign investment in the BTR sector. This legislation should help boost foreign investment in the BTR sector with the PCA announcing that it could deliver 80,000 new homes over the next 10 years.

Key impact of recent amendments

The key points from the recent amendments to the Bill that have been incorporated into the final legislation are:

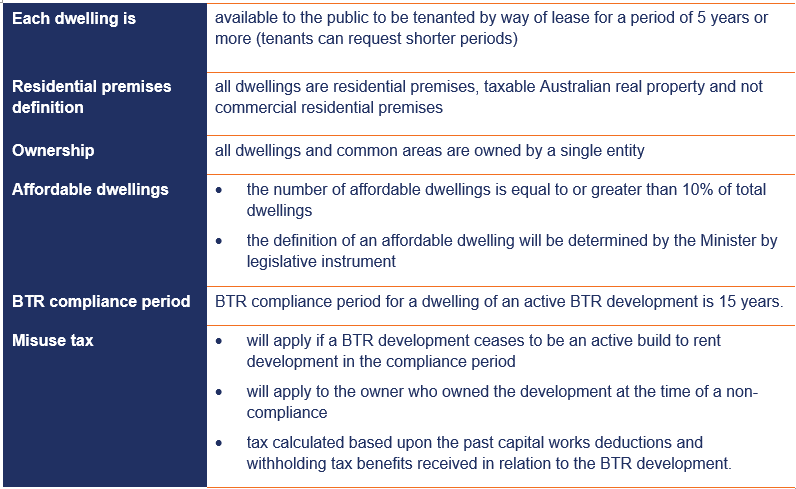

- It will apply for all eligible BTR developments even if they existed prior to 9 May 2023. This was an important change and ensures that those businesses pioneering BTR have not been left high and dry

- A minimum lease period of 5 years must be offered to tenants (tenants can request shorter periods)

- BTR misuse tax will apply to the entity that owns the BTR development immediately before that development ceased to be an active BTR development ensuring the appropriate owner bears the liability

- The lease terms are to be determined by the Minister by legislative instrument

- The definition of an affordable dwelling will be determined by the Minister by legislative instrument

Key features of legislation

The key features of the BTR MIT legislation are:

Dwelling features

For our original release on the BTR legislation and more details on the various State BTR regimes please click here.

How SW can help

We are specialists in property funds and property development and can provide valuable advice on your projects.

The State Taxation Further Amendment Bill 2024 introduces key reforms for Victoria, including expanded CIPT duty exemptions, strengthened FPAD and AOS provisions, a land tax exemption for charitable housing providers, payroll tax updates, and other minor amendments.

The State Taxation Further Amendment Bill 2024 (the Bill) received Royal Assent on 3 December 2024.

The key changes proposed by the Bill include:

- further duty exemptions for land in the Commercial and Industrial Property Tax (CIPT) Scheme

- reinforcement of the existing Foreign Purchaser Additional Duty (FPAD) and Absentee Owner Surcharge (AOS) provisions and

- a new land tax exemption for charitable housing providers.

Other amendments to payroll tax and other minor exemptions have also been proposed. We have unpacked these major state taxation changes below.

Key changes explained

Further Commercial and Industrial Property Tax (CIPT) exemptions

The CIPT scheme was introduced to replace stamp duty for future transactions involving commercial and industrial properties that have entered and continue to qualify under the scheme (referred to as CIPT Land). For further details take a look at our webinar or article on CIPT.

Under the newly introduced framework, stamp duty is intended to be levied one last time when a property enters the CIPT scheme through an initial qualifying transaction (‘entry transaction’).

Despite inclusion into the CIPT scheme, certain subsequent transactions (‘non standard transactions’) involving dutiable leases, fixtures and economic entitlements remain subject to duty.

The Bill introduces changes to provide upfront exemptions and concessions for ‘non-standard transactions’ which are defined as transactions such as the grant, transfer, or surrender of dutiable leases, or the acquisition of fixtures or economic entitlements related to CIPT Land.

Non-standard transaction exemptions

These ‘non-standard transactions’ will be exempt from duty if one of the following applies:

- at least three years have passed since the land entered the CIPT scheme, and the non-standard transaction agreement is made after this period or

- the entry transaction involved a 100% interest in the land, or the total interests transacted in the land amount to 100% and

- the value of the CIPT land when it entered the CIPT regime was not reduced by a lease over the land, economic entitlement in relation to the land and did not exclude the value of an interest in fixtures on the land.

The above upfront exemption is aimed at circumstances where appropriate duty has previously been paid as part of the land entering the CIPT.

Where full duty has not been paid, the Commissioner may exercise discretion to waive or reduce the duty payable on these transactions. The Commissioner considers:

- the proportion of the initial interest acquired during the entry transaction and any additional interests subsequently acquired in the land

- the degree to which the land’s value was diminished by other interests, such as leases, economic entitlements, or excluded fixtures, at the time the entry transaction was assessed for duty

- the time interval between specific transactions related to the land

- any other factors the Commissioner deems relevant.

Foreign Purchaser Additional Duty (FPAD) & Absentee Owner Surcharge (AOS) provisions

Under the Duties Act 2000 (Vic), FPAD applies extra taxes on the acquisition of residential land by foreign purchasers in Victoria. Similarly, under the Land Tax Act 2005 (Vic), the AOS imposes additional taxes on foreign owners holding land in Victoria.

The amendments are intended to address the risk that the existing provisions were invalid by reason of an inconsistency with theInternational Tax Agreements Act 1953 (Cth), which gives force to certain non-discrimination clauses in international tax treaties.

The Commonwealth Act was amended to explicitly state that state taxation laws override these international tax agreements in cases where these is an inconsistency. Despite this clarification, there remains a risk that courts could find the historical application of the FPAD and AOS invalid if they are deemed inconsistent with the Commonwealth law as it was at the time the alleged tax liabilities were incurred.

The new proposed provisions outline that if an FPAD or AOS liability is found to be invalid because of an inconsistency, a new replacement tax will be imposed which will mirror the original liability.

The proposed amendments will have the following practical effect, notwithstanding that the amendments will not apply if the liabilities are determined to be valid:

- if the FPAD or AOS liability between 1 January 2018 and 8 April 2024 are deemed invalid, the taxpayer will still owe the same equivalent amount under the new provisions and

- in circumstances where the taxpayer has paid the FPAD or AOS liability, the previous payment of the invalid tax will satisfy their liability under the replacement tax.

These proposed amendments ensure that the Victorian taxes are imposed as they were intended.

Exemption for charitable housing providers

The proposed changes under the Bill create a new exemption under section 78D of the Land Tax Act 2005 (Vic) (Housing provided for the relief of poverty) which applies to land owned, managed, or controlled by a charitable institution that is occupied, or available for occupation, by residents solely in connection with the institution’s charitable purpose of relieving poverty.

The new exemption is also available to vacant land owned by a charitable institution and declared to be held for such future use and occupation. However, the caveat to this is that the Commissioner must be satisfied that the land will be exempt land within 2 years, or a period longer as approved by the Commissioner.

As is the case with other land tax exemptions, the exemption may apply on a partial basis if the Commissioner is satisfied that only a part of land is land that meets the exemption requirements. Land tax will remain assessable on the part of the land that is not exempt.

How SW can help

Contact one of our state taxes experts to discuss how the proposed amendments may impact you.

Contributors

The Office of Management and Budget (OMB) has finalised significant changes to the Guidance for Grants and Agreements, aimed at improving clarity, consistency, and compliance in managing US Federal grants and financial assistance.

The OMB Guidance for Financial Assistance (Uniform Guidance) issued to all Federal agencies for use across all United States Federal Grants is the first major revision since its establishment in 2013.

The OMB originally established the requirements for federal grants management in 2013 consolidating and superseding requirements from several guidance documents related to the Federal financial assistance management and implementation of the Single Audit Act.

The four objectives for the current revisions, effective 1 October 2024 are:

- incorporating statutory requirements and administrative priorities to ensure consistency with statutory authorities

- reducing agency and recipient burden that included increasing several monetary thresholds that have not been updated for a number of years

- clarifying sections that recipients or agencies have interpreted in difference ways

- rewriting applicable sections in plain language, improving flow and addressing inconsistent use of terms.

What is the impact?

Organisations should review the revised Uniform Guidance changes and determine if there are any impacts on their current federal awards. Changes that may impact organisations include the following:

- increased the Single Audit threshold from $750,000 to $1,000,000 (section 200.501)

- increased the threshold for determining Type A programs to $1m if the total annual expenditures of all federal programs for a non-federal entity are $34m or less. This was previously $25 million or less (section 200.518)

- raised the de minimis rate non-federal entities can use for indirect costs from 10% to 15%. Recipients and subrecipients that do not have a current federal negotiated indirect cost rate may elect to charge a de minimis rate of up to 15% of modified total direct costs when this change goes into effect

- revised the threshold value for equipment from $5,000 to $10,000

- inclusion of a requirement that recipient and sub-recipient internal controls include cybersecurity and other measures to safeguard information

- changes to procurement standards.

SW are education specialists

Our approach to Uniform Guidance audits offers best practice expertise in a practical and commercial manner that is delivered using senior personnel with significant educational sector experience.

We have worked with 35 of the 41 major Australian universities and have extensive experience in assisting education providers with an appropriate audit of US Government sourced funds as required by the OMB Guidance for Federal Financial Assistance.

Our experts can assist with:

- quality expertise and industry insight in compliance with OMB’s Guidance for Federal Financial Assistance reporting requirements

- assessment of internal controls to ensure that research grants are managed in compliance with legislative/regulatory requirements

- direct link to Guidance for Federal Financial Assistance experts in the US, and

- tailored and collaborative audit methodology.

Contributors

Over 70,000 new reporting entities are to be regulated under the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Amendment Bill 2024 recently passed in November 2024.

The AML/CTF Amendment Bill aims to effectively deter, detect and disrupt money laundering and terrorism financing and strengthen the existing frameworks to better address these evolving threats.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) notes the reforms modernise the regime to reflect changing business structures, technology and illicit financing methodologies. The amendments aim to bring Australia in line with international standards set by the Financial Action Task Force (FATF).

Who is affected?

AML/CTF compliance has been expanded to include:

- lawyers

- accountants

- real estate professionals and

- dealers in precious metals and stones.

If you are an entity already covered by AML/CTF requirements you will need to review and update your program and related processes and procedures.

What are the obligations?

Entities who now are regulated under AML/CTF must ensure they are:

- enrolling with AUSTRAC

- developing an AML/CTF program and risk assessment tailored to your business

- conducting customer due diligence

- reviewing transactions

- reporting on suspicious activity and

- ongoing employee training.

What do you need to do?

Entities under the expansion will need to enrol with AUSTRAC by 31 March 2026 and be compliant with AML/CTF obligations by 1 July 2026. Reforms to tipping-off offence will commence on 31 March 2025.

AUSTRAC can take enforcement action for non-compliance with AML/CTF legislation including civil penalty orders, enforceable undertakings, infringement notices and remedial directions.

How SW can help

We are committed to working with clients to ensure they are prepared for and understand the new requirements.

Get in touch and our team can help with:

- helping you understand the recent AML/CTF reform

- development of a tailored AML/TF program

- AML/CTF review to meet AUSTRAC requirements.

Contributors

The ATO has introduced a Supplementary annual GST return as part of its engagement with the Top 100 and Top 1,000 taxpayers.

The returns will be used to assess the confidence level of a taxpayer’s compliance with GST law, and their investments placed into GST governance.

The Supplementary annual GST return will first apply to the 2024-25 financial year for those Top 100 and Top 1,000 taxpayers who received a GST assurance rating on or before 30 June 2024. The ATO will notify taxpayers if they are required to complete the return and provide the submission deadline. In the meantime, the ATO has published the form and detailed instructions so taxpayers can begin their preparation.

What information does the GST return contain?

The return contains several questions for impacted taxpayers and their advisors, including:

- how the taxpayer has actioned ATO recommendations, areas of low assurance or red flags raised as part of the most recent review

- how the taxpayer has maintained or increased its level of GST governance, and whether there have been any material business or systems changes that impact its GST control framework since the last review

- whether the taxpayer has undertaken any reconciliation between its audited financial statements and its annualised business activity statements

- whether the taxpayer has taken any material uncertain GST positions; and

- whether the taxpayer has identified any material GST errors in the period and how these have been rectified, and whether the taxpayer claimed any material amounts of credits in the period that were referrable to earlier periods.

Who needs to lodge?

Taxpayers who received one of the following on or prior to 30 June 2024 must lodge the annual return:

- Top 100 GST Assurance Report

- Top 1,000 Combined Assurance Review Report with a GST assurance rating

- Top 1,000 GST Streamlined Assurance Review

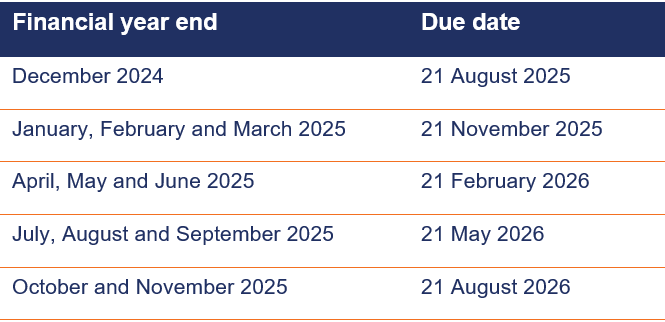

Due dates

Taxpayers who received a GST assurance report on or prior to 30 June 2024 must lodge the return annually from the 2024-25 financial year. The following table sets out the relevant due dates:

How SW can help

Reach out to our GST experts for help reviewing your GST governance and ensure your annual GST return is completed accurately.

Taxpayers should also review their progress on implementing action items from their last ATO assurance review as part of the process of completing the return. By executing action items, this will reinforces the ATO’s confidence in their compliance and reduces the risk of future challenges for your business.

Contributors

The introduction of a new accounting standard, AASB 18, represents a major change for financial reporting, particularly in the profit and loss statement for listed companies and Tier 1 reporters.

AASB 18 Presentation and Disclosure in Financial Statements has been introduced to enhance the presentation of financial statement as well as for transparency and comparability in reporting a company’s operating results.

This new standard will significantly impact financial reporting for listed companies and other Tier 1 reporters. However, AASB 18 also provides management an opportunity to more closely align how they measure, and view performance compared to how is presented on the face of the statement of profit or loss.

Why the changes?

Users of financial statements, especially investors, have raised concerns about the usefulness and comparability of information from financial statements.

Some common issues impacting the quality of information in financial reporting include:

- lack of clear definitions or guidance on how entities present their operating performance under previous standards

- divergence in practice regarding communication of alternative performance measures, commonly known as Non-IFRS measures or adjusted earnings

- material items being labelled as “other” in financial statements.

- AASB 18 was introduced to provide additional transparency and comparability for users of financial statements.

What are the changes?

There are three major changes under the new requirements:

1. New structure for presentation of profit or loss

The standard mandates that the profit or loss statement be structured into three categories:

- operating

- investing and

- financing.

It also introduces two new required subtotals:

- operating profit and

- profit before financing and income taxes.

AASB18 clarifies the definitions of the operating category and operating profit, ensuring consistency in how the company’s results are presented. There are new requirements for categorising and disclosing expenses, allowing for a more flexible presentation compared to the current binary classification based on function and nature.

2. Disclosure of how management views the performance

Many companies, especially listed entities, choose to report alternative performance measures, also referred to as “non-IFRS”, such as adjusted earnings, EBITDA, or adjusted EBITDA. Some of those measures will become Management-defined Performance Measures (MPMs) and will be subject to the new standard’s disclosure requirements.

If a company reports MPMs in other areas of reporting, such as the directors’ report, it must bring that information into the notes of the financial statements and reconcile it back to the nearest subtotal in the profit or loss statement. The tax and non-controlling interest (NCI) impacts of those reconciliation items must also be disclosed.

Management must explain in the notes the reasons for selecting the MPMs and any changes to these measures. All the MPMs and related disclosures will be subject to audit as they form part of the notes.

3. Grouping and labelling of information

There are enhanced requirements regarding the grouping of information and the disclosure of items labelled “other”. Further guidance is now available on how and when to aggregate or disaggregate information.

Although AASB 18 primarily impacts the profit or loss statement, the new aggregate and disaggregated requirements may also impact on other areas of the financial statements.

Companies are also now required to present interest and dividends received under ‘investing cash flows’, while payments must be recorded under financing. Previous accounting policy choices regarding such presentations have been removed.

What will be the impact?

The adoption of the new standards is expected to have a major impact across all Tier 1 financial reports. Management will need to consider whether any of its contracts and remuneration, often linked to profit or loss, will be affected. Loan covenants linked to profit or loss may also need to be clarified.

Depending on existing systems and reporting processes, the financial reporting impact ranges from remapping the chart of accounts to requiring changes in systems and processes. For example, properly categorising foreign exchange transactions could be complex.

Companies will need to train internal staff involved in financial reporting and communicate changes to various internal and external stakeholders, as these changes may also impact on budgeting and forecasting tools and reports.

When to take action?

The new standard will be mandatory for the first time on 1 January 2027. For entities with a December year-end, this means it will apply to the year ending 31 December 2027. Comparative information will also be required.

Many listed companies report interim financial reports; AASB 18 will be applicable for any interim reporting starting 1 January 2027.

Early adoption of the new requirement is permitted by the standard.

What about NFP and Tier 2 reporters?

For Tier 1 not-for-profit entities, the mandatory effective date is 1 January 2028, which is one year later compared to their for-profit counterparts.

At this stage, AASB 18 does not apply to those preparing financial reports under the Simplified Disclosures Standard, commonly known as “Tier 2”. AASB is currently working on strategies for Tier 2 entities.

How SW can help

Our team of audit and assurance experts are fully informed of the requirements of the new accounting standard and can assist with providing guidance for your business, as well as keeping you abreast of developments from an Australian reporting context.

We can:

- provide additional information and training for staff

- conduct an impact assessment and provide recommendations.

Reach out to your SW contacts or the key contacts here for a conversation.

Contributor

Both houses of the Australian Parliament have now passed mandatory climate reporting legislation, with a new bill that will require large companies to prepare annual sustainability reports. With the aim to enhance the transparency and comparability of climate-related information.

Introduction

To enhance the transparency and accountability of climate-related matters, on 9 September 2024, the Australian Parliament passed Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024.

This highly anticipated bill mandates that large entities adhere to the new sustainability reporting standards issued by the AASB, which align with international standards. The first group of entities will be required to submit their sustainability reports from annual reporting periods beginning 1 January 2025, with smaller entities being phased in over the following years.

New reporting requirements

A new sustainability reporting requirement has been introduced for disclosing information on climate-related matters. When applicable, the sustainability report must be prepared alongside the annual report. This report will adhere to sustainability reporting standards issued by the Australian Accounting Standards Board, which are closely aligned with international standards.

This alignment will ensure much-needed comparability across companies. The Australian equivalent standards propose making climate reporting mandatory, while other sustainability topics, such as biodiversity and human capital, remain optional.

Additionally, the final bill mandates further scenario analysis based on feedback from Parliament. Entities must disclose scenario analysis using at least both of the following scenarios:

- Low warming scenario: global average temperature increase is limited to no more than 1.5 degrees and

- High warming scenario: global average temperature increase exceeds 2.5 degrees

Who has to prepare annual sustainability reports and when

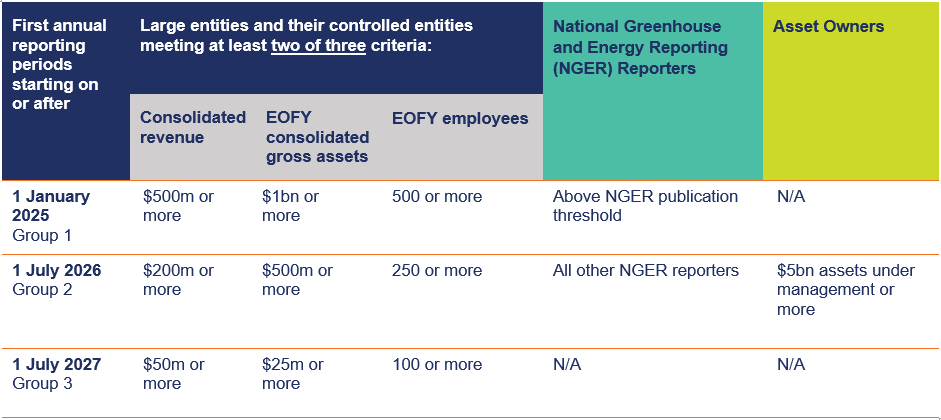

The government proposes a phased approach based on the size of the entities. The table below sets out the details of the threshold and date for the implementation.

The above Table is summarised from Explanatory memorandum of the bill

Group 3 entities are required to make climate disclosure if they have material risks or opportunities.

What happens to the sustainability standards?

Following the consultation feedback, the AASB has decided to revise the titles and numbering of the sustainability standards to align with IFRS S1 and S2. The new titles will be AASB S1 General Requirements for Disclosure of Sustainability-related Financial Information and AASB S2 Climate-related Disclosures. AASB S1, which covers broader sustainability topics, will be a voluntary standard, while AASB S2, focusing on climate, will be mandatory. The standards are expected to be issued in the coming weeks.

What do companies need to report?

The disclosures will need to follow the stainability standards issued by the AASB. The key areas of disclosure include:

- governance and strategies for climate-related matters

- risks and opportunities associated with climate change

- metrics and targets associated with emissions. This includes direct emissions by the company and from energy consumption (Scope 1 and 2 emissions) and emissions in the value chain (known as Scope 3 emission).

In addition to a qualitative description of the risks and opportunities, the company is also required to disclose quantitative scenario analysis. There are several reliefs proposed by the government in relation to more complex disclosure of Scope 3 emission and quantitative analysis.

The above disclosure will need to be included in a new annual sustainability report. The structure and content of the sustainability report consists:

- the climate statements for the year

- any notes to the climate statements

- any statements required by other legislative instruments to include matters concerning environmental sustainability.

- the directors’ declaration about the statements and the notes.

The annual sustainability report will be presented together with the financial report.

Audit requirements

The company’s financial auditor will audit the sustainability report. The auditing standards setter, AuASB, is currently consulting with stakeholders to determine the required level of assurance for climate-related disclosures.

Based on the most recent exposure draft, we understand the proposed audit requirement will also be phased in. We expect that in the first year of reporting, different content will be subject to different assurance requirements as below:

- limited assurance over scope 1 and 2 emissions for the first year and moving to reasonable assurance thereafter

- Other area’s disclosures will be gradually subject to review or audit from the second year onwards.

What are the next steps?

- Start preparing now!

- Familiarise yourself with the content of the proposed standards and how it affects you

- Perform a gap analysis to identify data/capability requirements

- reach out to your SW contact to help you get started

How SW can help

We can conduct gap analysis and prepare a road map to guide you on your journey.

Our team of audit and advisory experts are fully informed of the requirements of the sustainability accounting standards and can assist with providing guidance for your business, as well as keeping you abreast of developments from an Australian reporting context.

Keep an eye out for further alerts from us in respect of the finalisation of the sustainability standards by the AASB which is expected in the next few weeks, the sustainability reporting assurance standard under development by the AuASB and any announcements from ASIC on this new area.